MTG Rates at 2002 Levels

- David Bryant, MBA | CFP

- Oct 31, 2022

- 2 min read

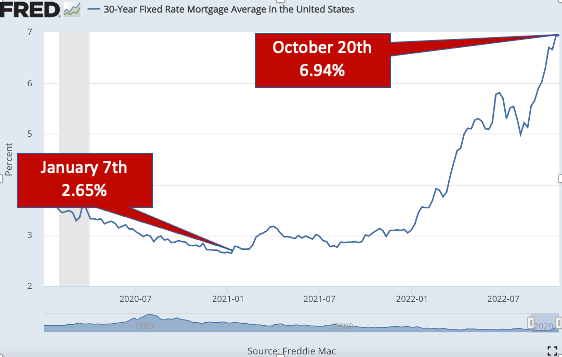

The U.S. economy continues to slow amid the backdrop of persistent 40-year high inflation pressures, as well as an ultra-aggressive Fed monetary policy tightening campaign—which delivered a 75 basis-point (bp) rate hike for a third-straight meeting. The rate hikes translated into higher borrowing costs, which is beginning to slow demand, notably in the housing market. The 30-year mortgage rate is currently 6.94% which is 4.29% higher than the lows of 2.65% set on January 7, 2021.

The S&P CoreLogic Case-Shiller National Home Price Index measures average home prices in major metropolitan areas across the nation. According to the index, the average home price fell 1.1% in August from July. This is the second consecutive month-over-month decline. With that said, the index is still up 13% year-over-year. A new homeowner who purchased a home at the peak of the market with a sub 3.5% mortgage is still in better shape financially than someone who buys a cheaper house with a 7% mortgage. The housing market will likely soften; however, I don’t foresee a housing crash like the 2007-2008 financial crisis. Click on the video below to see how lower home prices impact inflation.

Stock Markets Shake off Weak Tech Earnings

Despite disappointing earnings reports from large-cap technology companies, U.S. equity indexes finished higher after a stronger-than-expected GDP report. The Russell 2000 Index soared 6%, while the S&P500 added 4% and the Nasdaq Composite rose 2%+. Ten of 11 S&P sectors finished positive, led by industrials, financials, consumer staples, and utilities. Treasury yields and the U.S. dollar backed off from recent highs but remained in firm uptrends. The latest U.S. inflation report showed prices slowing their ascent but still rising, with the Core PCE Index up 0.5% MoM and 5.1% YoY. A modest deceleration in wage growth was viewed as a positive but likely won’t change the Fed’s intended path on rate hikes.

Comments