Federal Reserve Cuts Rates

- David Bryant, MBA | CFP

- Sep 25, 2024

- 2 min read

The recent decision by the Federal Reserve Bank to cut interest rates by 50 basis points has been highly anticipated and has significant implications for the economy. This move comes after over nine months during which the Fed signaled a potential rate cut, reflecting their cautious approach to monetary policy. The decision to lower interest rates aims to stimulate economic growth and address potential challenges in the labor market. Looking ahead, the Federal Reserve has indicated a plan to implement further rate cuts in the coming years. They are projecting another 50 basis points reduction by the end of this year, followed by additional cuts in 2025 and 2026. While the estimate for 2026 may be subject to change based on evolving economic conditions, investors need to stay informed and prepared for potential shifts in monetary policy. For further insights into the implications of the recent rate cut and the Federal Reserve's plans, you may find the Wall Street Journal's video on this topic both informative and insightful.

Even though the Federal Reserve's inflation target of 2 percent remains unmet, the central bank has shifted its focus as it no longer perceives inflation as the primary threat to the US economy. Instead, the Fed has turned its attention to the unemployment rate, which has seen a recent uptick to 4.40%. While this figure is historically considered low, the fact that it is on the rise is a cause for concern. This increase in unemployment comes at a time when more individuals are entering the workforce through immigration and increased labor force participation rates. As a result, the Fed closely monitors these trends to ensure that the economy remains stable and resilient in the face of evolving challenges.

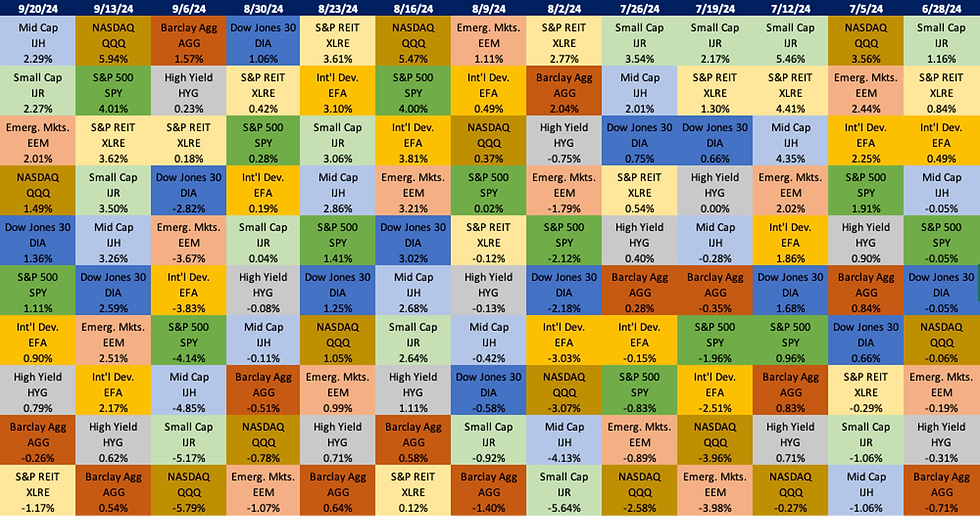

Index Tracker

Comments